The process of buying any property in Ireland is a daunting experience – never mind the added stress of buying a cottage which will most likely have inherent structural issues. For people buying in the Irish market for the first time, the process can be very confusing and frustrating. This article will give you an overview of the process.

The Budget

The very first step to take is to ascertain your budget, especially in these times of economic uncertainty. If you are lucky enough to be in control of your own finances and don’t need any help from the banks then you already have this step covered.

However if you are at the mercy of the financial institutions like the majority of people you will need to jump a few hoops before you will be granted a mortgage. In recompense for past errors in judgment, banks are no longer welcoming buyers with open arms despite what their glossy adverts might say. Every bank has different application criteria and they are constantly changing, if you secured a mortgage in the past that doesn’t mean you will be successful now.

When applying for a mortgage it is important to be aware of what the mortgage offer entails – the interest rate, what kind of breaks you will be allowed. As an example of this, when I was securing a mortgage to renovate a property the bank I was dealing with didn’t give an option of a 3 month payment break before starting the first repayment – important for renovators on a tight budget. I didn’t find out this information until after I had jumped most of their hoops and I had to start the process all over again with another bank.

You can decide to apply for the mortgage before or after you have placed an offer on the property. If you wait until after the offer has been accepted you run the risk of loosing the property if you are not granted a mortgage easily. The mortgage application process can be drawn out and the seller might opt to go with the finance secured bidder rather than risk the sale for a few extra euros. The other option is to apply before, commonly known as mortgage in principal, this gives you outline approval and makes applying for a full mortgage quicker and easier. However it is worth noting that there is a time limit of about 3 months on mortgage in principal and finding your ideal cottage and the negotiation process can take considerably longer.

Make sure that you have your booking deposit ready, it is an amount that the bank will not usually forward you – usually about 10% of the purchase price. You will need this to secure your property.

The Search

The search to find your dream cottage can be a long and arduous task. There will have to be compromises on some aspects so it is important to sit down initially and write out a wish list in order of your priorities. For example, if location is paramount to you – it will be at the top of your list. Examples of these are:

- Location

- Orientation (eg: South facing)

- Size of site

- Proximity to amenities & services

- Condition of stone

- Thatched Roof

- Double height ceilings

Once you know what you want and your maximum budget you are ready to start your search. The property websites are a good place to start for a general look about, they include property listings from a variety of Auctioneers, the most popular of these are:

www.daft.ie

www.myhome.ie

www.propertynews.com.

Also worth a look is www.sellityourself.ie a website where home owners can bypass the Auctioneers fees. This can be a good place to pick up a bargain but the variety of property on offer is considerably less than the conventional property websites.

If you have a particular area in mind visiting the local Auctioneers is usually the best option as they may have the inside track on properties not yet listed on the websites. Some property owners also dislike having their properties listed publicly – the country is a small, very local place and some inhabitants do not like others knowing their business. They will list their property with the Auctioneer but instruct them not to advertise it publicly. For details of the Auctioneers in your local area you could do a search of Auctioneers that are on one of the property websites or look up www.goldenpages.ie.

Newspapers also produce property listings with the national papers producing a weekly listing one day a week as follows:

- Irish Times – Thursday

- Irish Independent – Friday

- Irish Examiner – Saturday

Weekly regional newspapers such as the Kerryman, Limerick Leader, Clare Champion etc… also contain property listings – so head down to a newsagent in the area you are interested in to pick up a copy of the local paper. There has been an increase in the amount of free local newspapers in circulation such as The Cork Independent, mostly they are delivered door to door but they can also be picked up in most shopping centers and supermarkets. These types of newspapers rely on advertising solely for their revenue so are a good place to check out property adverts.

Again if you have an area in mind and you have time on your hands, you could simply get in your car and drive around. Often talking with the locals of an area will let you in on the inside track when it comes to local properties not yet on the market. A landowner may be contemplating a sale and would be delighted if someone made an offer – it makes the transaction relatively easier for all involved.

If you are short on time and resources you could simply employ professional representation such as www.buyersbroker.ie. Buyers Brokers are common practice in the US and are becoming more popular here. They act as the buyers representative throughout the buying process – providing a range of services from advice, simple property searches and negotiation to full scale property searches and representation throughout the whole property transaction. They are cost effective as their fee is generally less than what they save you on the purchase price.

The Viewings

When you finally locate a property that ticks all the right boxes on paper it is time to take the next step – the viewing. You will usually have to arrange this through the auctioneer representing the property. They will meet you at the property and show you around highlighting its best selling points. It is important to remember that the Auctioneer represents the seller, they may come across as friendly and trustworthy but their job is to maximize the sale price for the owner. Keeping this in mind it is advisable to play your cards close to your chest – do not impart with useful information like your maximum budget. This seems very obvious but in the heat of the moment it is easy to slip up.

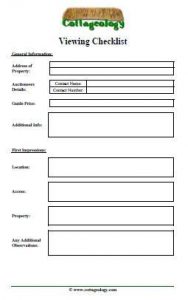

The search for a cottage or dream home can be a long drawn out process so I have put together a viewing checklist to help you keep track of the properties you have viewed. This checklist also gives you an opportunity to document your impressions and feelings about the property. If you have been viewing several properties over a period of time it is very easy to forget vital information for your decision making process. I would highly recommend jotting down a few notes to jog your memory.

The search for a cottage or dream home can be a long drawn out process so I have put together a viewing checklist to help you keep track of the properties you have viewed. This checklist also gives you an opportunity to document your impressions and feelings about the property. If you have been viewing several properties over a period of time it is very easy to forget vital information for your decision making process. I would highly recommend jotting down a few notes to jog your memory.

Sometimes it is hard not to be impetuous when you locate exactly what you have been looking for but try to give yourself a night to think it over at the very least. This will allow the idea to settle, new questions to form and much more rational decision making. If you are still interested in the property arrange a second viewing.

Part II will take you through the Engineers, Solicitors & closing of a sale.

If you have any experience or tips from your cottage search that you’d like to share, email me or comment below!

[…] is Part II of this article – for Part I see – Buying an Irish Cottage – Part I […]

Very informative article there..thanks.

Hi do I need planning to renovate an old cottage that hasn’t been lived in for a number of years?